Comic Investing: High Grade CGC—v— Every Week Raw

Comic Investing: High Grade CGC—v— Every Week Raw https://thelongboxers.com/wp-content/uploads/2018/10/TLB-Investment-Strategy-Comparison-1024x585.jpg 1024 585 Craig Coffman https://secure.gravatar.com/avatar/e77f20d9285a48d7153bc69f693c889d?s=96&d=mm&r=gInvesting in comics is super fun and potentially lucrative, but you need to figure out your persona.

Pay up for a CGC book or uncover your own raw gem?

A common dilemma for collectors and investors: CGC or raw? Do you like to hold or turn and burn? Or a mix of the two? Both are absolutely viable approaches to generating money from this hobby. Many folks will have firm stances and completely ignore or disrespect the other. I am of the opinion that you can work well with both.

Everything really depends on who you are as a collector / investor. It takes dedication and effort to make a solid go of buying / selling comic books. This truly is not for everyone and you need to think about what you are hoping to achieve. That said, let us dive in!

NOTE: Before reading more, I need to acknowledge that both of these cases are based off of hypotheticals values and not factual numbers. It should be obvious why as you read, but I wanted to make sure you understand ahead of time.

Two Main Approaches for Investing in Comics

Both approaches require knowledge and time. That is just the way it works. Anyone can get lucky or just follow the herd. Neither are keys to success. You need to look hard at books already in existence or books coming out for new release Wednesday. It is a grind and dedication. You need to research and look at past trends, or any level of data to support or (more importantly) refute your thoughts on titles.

If you are only looking for support while ignoring the negative on your thoughts, you will likely be wrong. This does not mean you immediately abandon your stance and thoughts because someone else says it sucks.

It means you must develop a methodology of looking for information to poke holes in your opinion, evaluate the new information and then see if you keep your enthusiasm. More often than not is just modifies your expected outcome. And that is good.

CGC or Raw: Building Your Collection

How you go about getting your collection can be any number of ways. Some people buy new and build it from the ground up. Others only target established keys and build from a market perception of stable characters.

Most folks do some mix of both CGC books and raw books. The great news is there is no wrong way. But often times online we read about ‘the only way’ to make money from comics. That is hogwash. It really comes down to how you want to build your investment portfolio. CGC or raw? Both can completely work.

The set up: buy an established graded book (CGC grading for this write up) at 9.8 that is undervalued OR hit the new racks weekly. Given reasonable motives and histories, I am not here to say that either approach will or will not work out. I am only showing numbers and pointing out what I can see and why or why not you might follow a particular approach.

NOTE: If you are only collecting and buying because you love comics, then this is not really aimed at you. Both CGC or raw copies are fine to have in your collection. Buy what you like and enjoy your books. While you might take a few tips from here, it is not meant for the collector directly.

High Grade Book Approach

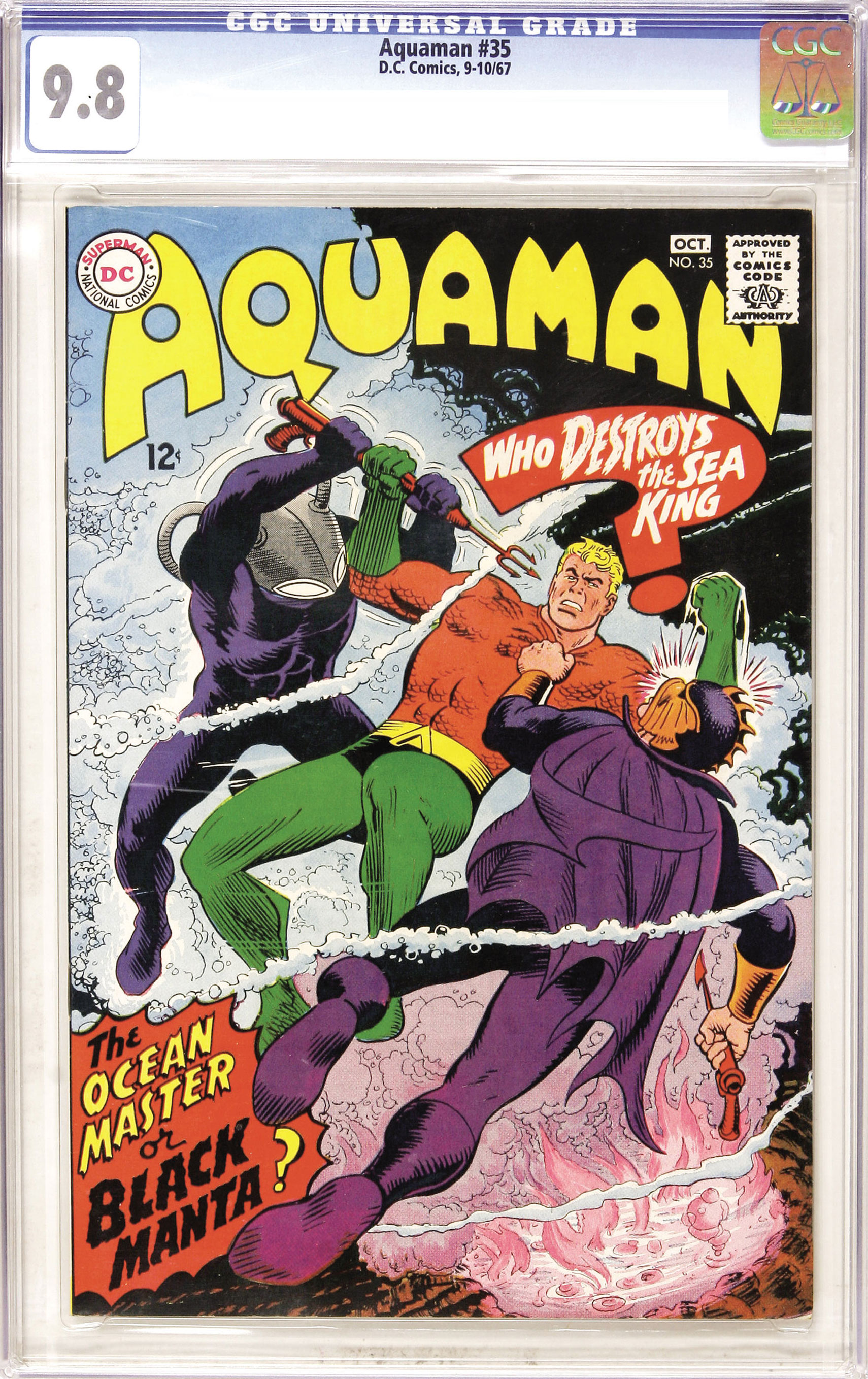

This approach is like a traditional stock market buy low / sell high approach. I was going to use a different book, but decided to go with a book that I have seen talked about. Aquaman 35, first appearance of Black Manta. If you do not know, he is an established foe of Aquaman and there are hopes of movie hype.

Last reported sale of a 9.8 was in November of 2007 $1,434 according to GoCollect. Now, for a book printed in 1967 with only 1 9.8 on the CGC census, that is a pretty impressive price for that book. The idea was that this book could be sold in 25 years for $25,000. The main motivators for this are age, scarcity in grade, key issue and potential movie bump.

Here Come Some Numbers

From a math point of view, you are looking at a return of 17 times your original investment. That becomes $942 per year. That is certainly not bad. If you could get 65% interest per year of your initial investment for 25 years that is not bad! I think most people would sign up for that.

The big thing to consider here is that you only have a single copy of the book and that all your funds are locked up in this book until you move to sell. But, again, you are watching the perception of growth over time in your investment. That is exciting and the overall numbers are enticing.

Here are a few things to consider

Sand Through the Hourglass

The time to find a book to target is not all too long. You need to research and review all the information you can. This is a character history, popularity, CGC census number, etc. You can do this in about a week after you establish characters / books you want to target.

Run through all your list and land on the ones that still make the cut. But it is not that easy since you might not be able to buy the only 9.8 copy of Aquaman 35. It very well might not be for sale. So you have to wait and hope your books become available. That is something you have no control over and should not be over-looked as a major hurdle.

Are You Feeling Lucky?

This approach also takes on a heavy does of luck. Assuming that you are able to get that return, you have to assume that someone will have the money when you decide to sell and that person has a strong affinity to Aquaman or Black Manta.

In my opinion, it is hard to know what will be liked years down the road. It is also very hard to know if a character that is not a ‘main’ (not looking for arguments about who is / not a main character), being Black Manta, will draw those deep pockets. Perhaps an Aquaman fan will, or a completist. But expecting 25K for a book that has not been strong over time is a big risk, with admittedly a big reward.

Every Week Turn and Burn

This is the Day Trader mentality. Nothing is sacred and the goal is just stacking bills.

This approach sends you to the Wednesday wall to test your skills at predicting hot raw books. For this, we will assume a budget of $100. The big difference here is that you are looking to turn your money over weekly.

It also assumes that you are not hitting on every book. But you can get a pretty good insight as to what books you should target. I am going off of $4 per book, but this should be less if you really embrace this approach (more later). So I am going from 5 copies of 4 titles, and a single variant around $20.

Rinse and Repeat

Every week there are new releases you can turn and sell immediately for $10-20 dollars. You are selling into a perceived hype or scarcity, and you HAVE to sell. There really is no waiting around.

Based off information from folks who do this approach, we can assume one book will hit the highs, one book will hit the low, and the other two will be just over cover. Again, these are curated selections and not just _any_ book on Wednesday. The variant should be a 50-100% gain, again very well curated.

This is at retail. It is important to note folks doing this actively are paying less since they are pre-ordering or working deals with their LCS. After all is said and done, you are making $64 per week. Many folks think that is ‘peanuts’ and not worth their time. That might be true. But if you are willing to be dedicated and can put in the time (LOTS OF TIME), you can make it work. The upside of this is that you get your investment back quickly.

Persistence is Key for These Keys

I cannot understate what an immense grind it is to achieve this. You need to spend hours on boards and research on releases, variant cover ratios, and other wares to make this work. It is absolutely mandatory to strike a relationship with an online shop or have a cool LCS to make things happen. With a bit of hunting, one should be able to find 20%+ discount on cover price (depending on how early you buy) and that is where you really start to make even more profit.

Some LCS will even help you get the higher ratio variants by picking up the cost of the extra issues needed to hit the requirement. I know that there are shops that will let you do this, and it is a big gain.

Start Those Stacks

Many folks think that is not enough return to justify the time of raw books and tout only CGC for serious collectors. But if this is how you do it and it becomes part of your routine, it can be not as bad once your approach gets set. I mean, you do not have to make a new relationship for every book every week.

Once that is in place, you really just need to figure out what books you are targeting. The thing that does take time is the shipping. For this to work, you likely have to be on eBay (or something similar) to access a market willing to buy your books.

You are looking at gains of (based off lower-end range):

5 @ $15 = $75

5 @ $10 = $50

10 @ $5 = $50

1 @ $30 = $30

TOTAL = $205

LESS FEES = $164 (20% removed)

LESS INVESTMENT = $64

ANNUAL RETURN = $3,328

If we extrapolate this over the same 25 years above, we land on gains of $83,200. Yowza!

And you do need to take into account that you will not always hit. As above, a bit of luck is needed with this strategy as well. But there is a bit less IMHO as weekly books have tonnes of ‘Hype-Men’ out there driving desire. Yet, there very well could be weeks where there are no high value books, but converse also holds true. But even at doing half as good, you are still looking at $41,600 which is no small shakes.

Give Your Life to the Game

In my opinion, if you can commit to this it is the way to go if only for one reason. You are getting your money back out of your investment immediately. There is no hoping in 25 years you can find a market for all the books you acquired. That is a super important factor.

If you need another incentive, you also get your profits right now which you can use to either up your weekly investment OR buy other high grade books! This allows you to essentially double dip. Or to use ‘earnings’ to add solid pieces to your collection that you do not need to worry about selling. Things are bought on ‘house’ money essentially.

TIP: You need to have shipping charges cover your hard costs of shipping supplies, and maybe make you some cents on each book shipped.

Tallying the Tape

So…CGC or raw?

It is easy to look at both approaches and feel one is stronger than the other. I must stress again that it takes a lot of work to make it happen no matter your approach. It can, and does, work out favorably but you absolutely have to plan on putting in time and effort to get your comic book avenues in place. The long term approach requires some solid prognostication and confidence, but even after you lock it in you need to find the book available.

While both CGC and raw have solid pros and cons, there is a slight edge in the weekly approach as you know those books should be available and not too hard to find. Particularly when you are pre-ordering months before they actually arrive on the shelf. The other approach requires someone else to be selling a book at a time / price you are wanting. That is obviously less predictable.

No Losers Here

In the end, I am not trying to say one is better than the other. Or that you need to change the way you approach the investing in comics. I have simply heard so many people with ‘absolute’ stances on one approach over another.

I wanted to help illuminate both approaches to give you ways to consider either approach. Many investors hear of an approach and never explore alternatives. I figured it is worth laying out scenarios to illuminate some of the ups and downs to each.

If you are wondering, I am probably 95% long term. I simply do not have the time to take on the weekly approach.

In closing, please remember both CGC or raw comparison of the above cases are based off of hypotheticals and not fact. That is, no one knows what a 9.8 Aquaman 35 will be in 2032 or what the Wednesday wall will yield over the same period of time. All information is based off other’s reporting / projecting and are purely for comparison of the two approaches. Numbers can fluctuate. I would never advise anyone to take these approaches as fact.

Leave a Reply